nebraska sales tax rate changes

Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. Effective October 1 2002 the state sales and use tax rate has increased to 55 up from 50.

Colorado Income Tax Rate And Brackets 2019

Manley will start a.

. Nebraska has announced local sales and use tax rate changes effective July 1 2021. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of. The Nebraska state sales and use tax rate is 55 055.

LB 432 reduces the corporate tax rate for Nebraska taxable income in excess of 100000 from 781 to 750 in tax year 2022 and to 725 for tax year 2023 and beyond. The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax. 31 rows The state sales tax rate in Nebraska is 5500.

See the County Sales and Use Tax Rates section at the. Local Rate Changes Humphrey will increase its rate from 15 to 2. Ad See industry updates new tax laws and some long-term effects of recent events.

Senator Tom Briese says a changing Nebraska economy means the states sales tax system. A new 1 local sales and use tax is being imposed in the. Effective April 1 2022 the city of.

The Avalara Tax Changes 2022 report includes information to help you stay compliant. 800-742-7474 NE and IA. New local sales and use taxes.

A temporary rate change has been established in the state of Nebraska. The Avalara Tax Changes 2022 report includes information to help you stay compliant. 18 rows Local sales and use tax rate changes have been announced for Nebraska effective October.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. A new 05 local sales.

Nebraska Department of Revenue. More are slated for April 1 2019. Print This Table Next Table starting at 4780 Price Tax.

19 rows Raised from 55 to 6. Ad See industry updates new tax laws and some long-term effects of recent events. There are no changes to local sales and use tax rates that are effective July 1 2022.

Exemptions to the Nebraska sales tax will vary by. Nebraska Sales Tax Table at 55 - Prices from 100 to 4780. This study recommended that business-to-business sales or business inputs be exempt a structural principle that still exists in todays law that is supported by economists as.

Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. The original rate of 50. Right now sales and use taxes make up about 35 percent of the states budget.

Motor Fuels Tax Rate. We provide sales. Simplify Nebraska sales tax compliance.

With local taxes the. The Nebraska state sales and use tax rate is 55 055. The Nebraska state sales and use tax rate is 55 055.

Average Sales Tax With Local. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019.

January 2019 sales tax changes. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05.

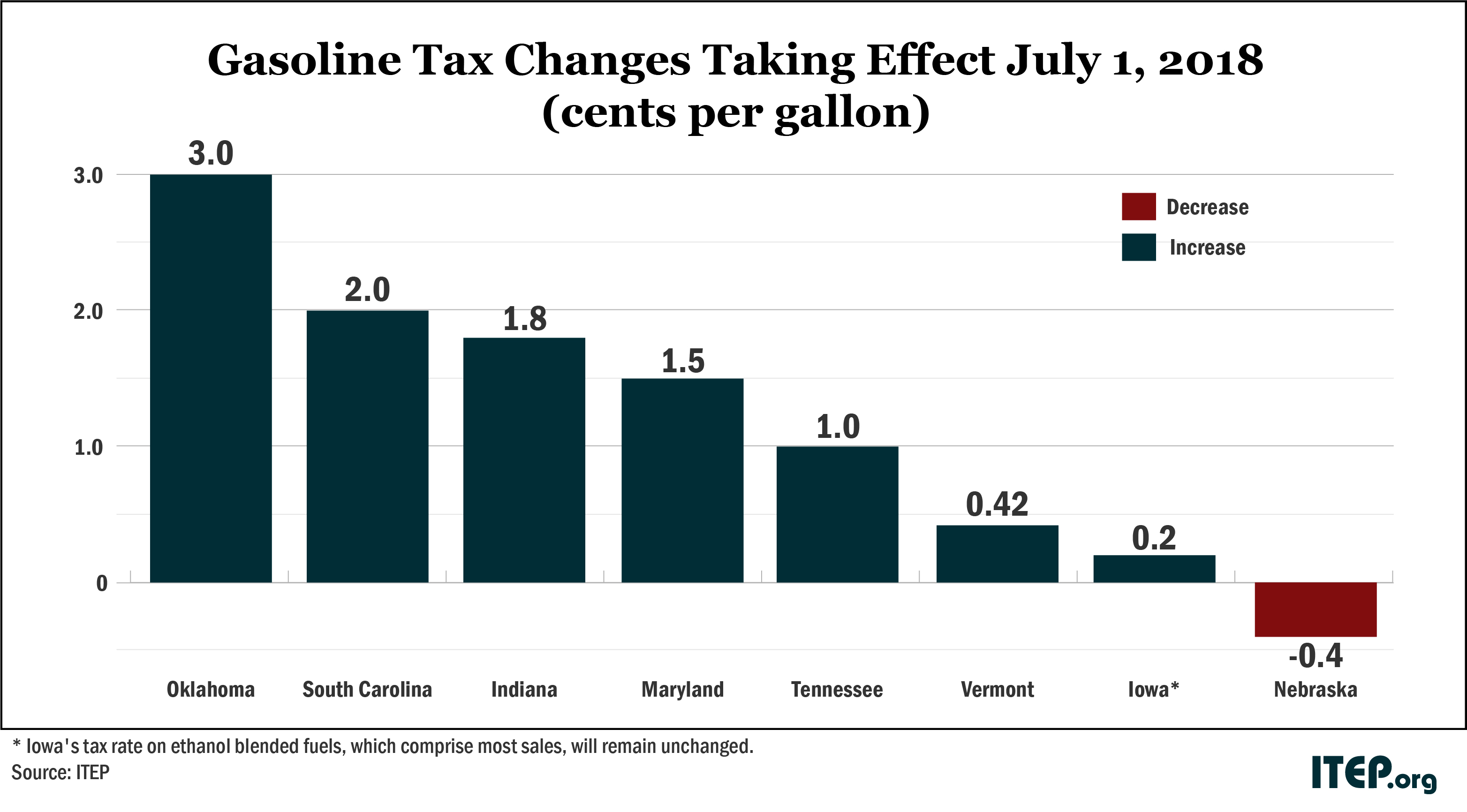

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

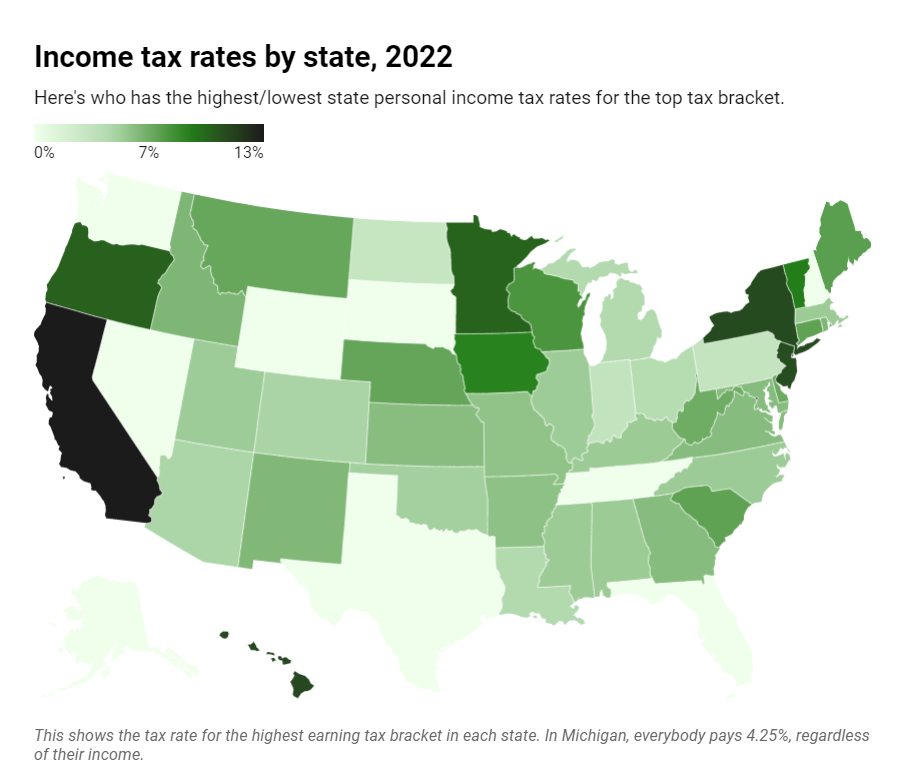

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Sales Tax On Grocery Items Taxjar

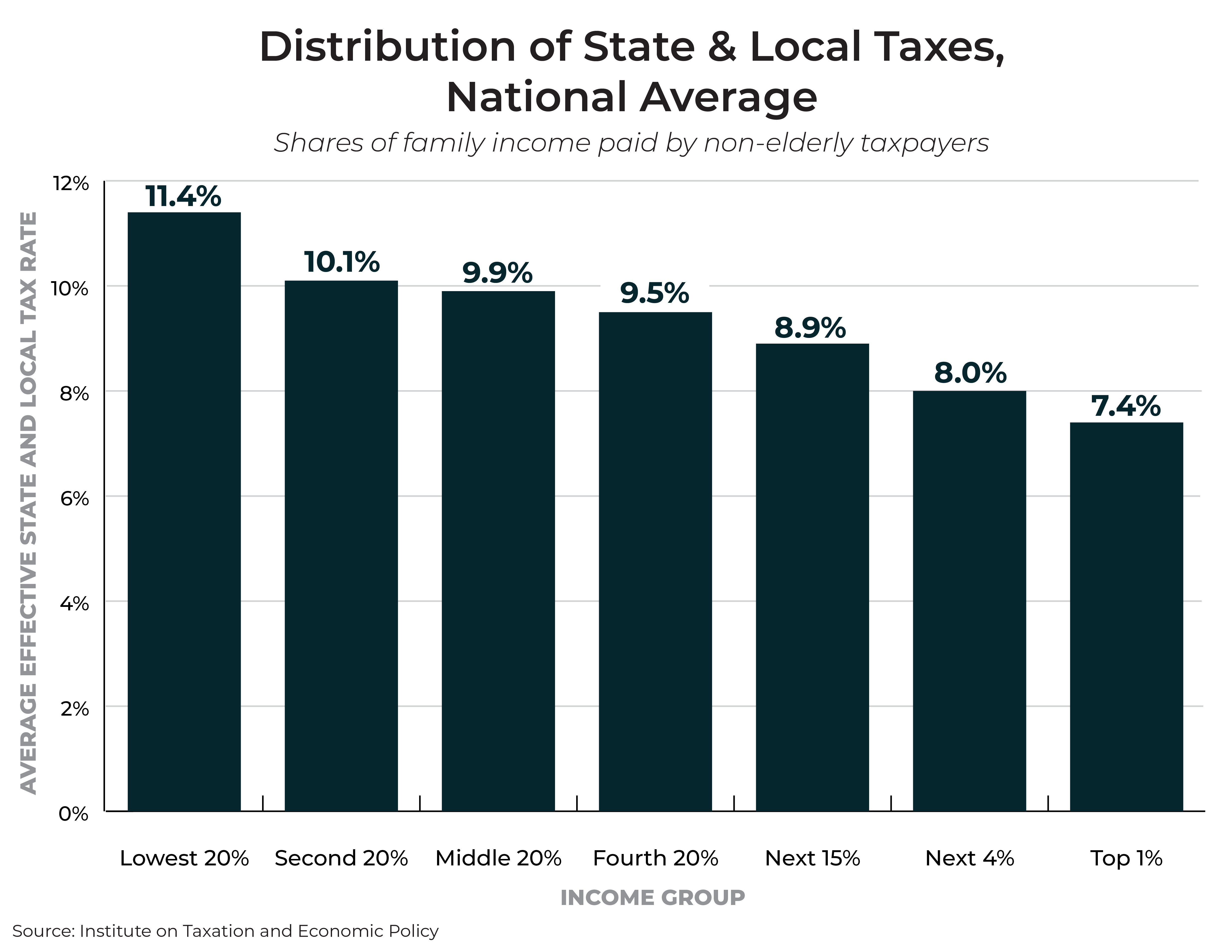

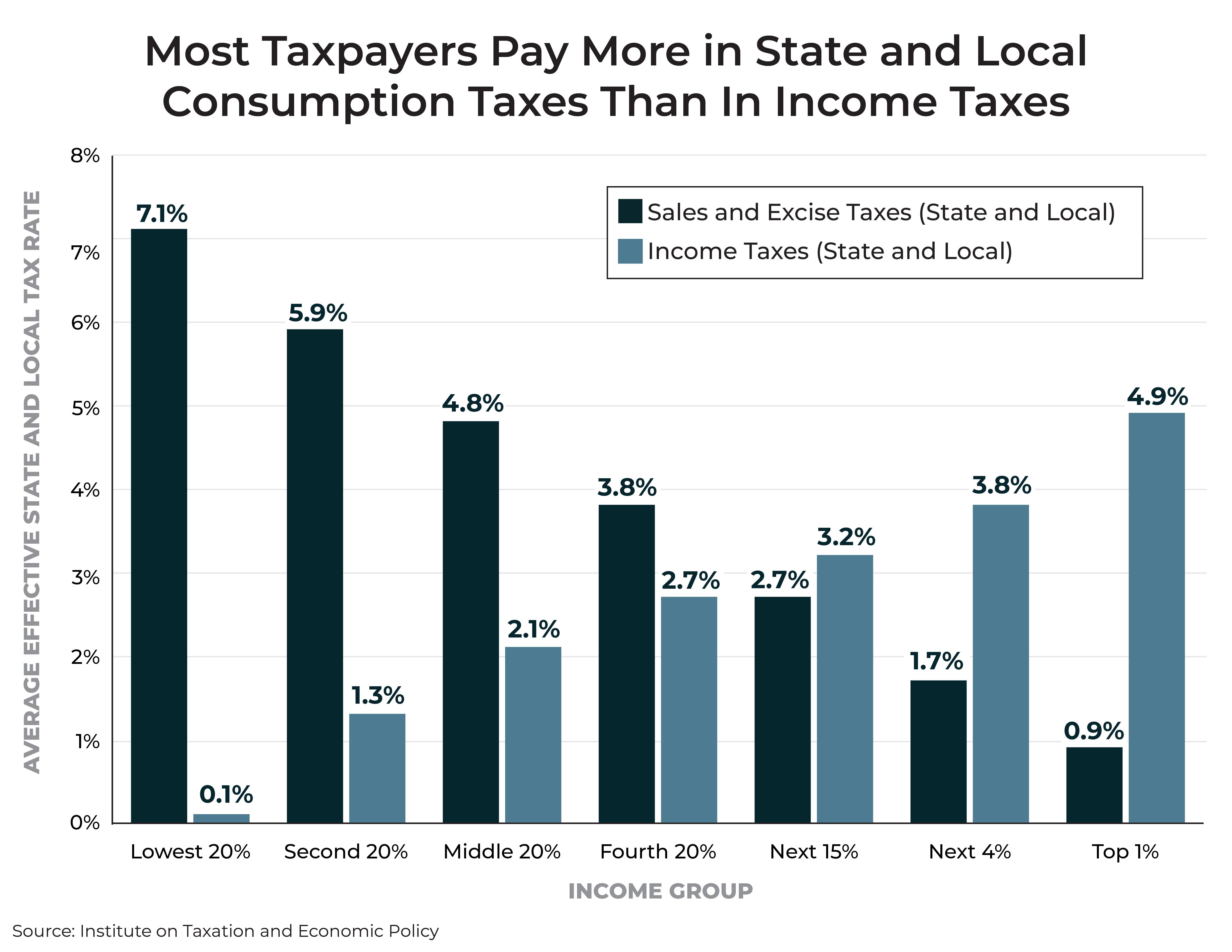

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

Ranking State And Local Sales Taxes Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Nebraska Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)